Trader Cheat Sheet #4 – Murrey Math Lines

Posted: May 10, 2013 Filed under: Cheat Sheet, Free Tools, Trader Tools, Trading Plan, Trading Rules | Tags: 2013, Cheat Sheet, Free Tools, Setups 2 Trade, Trade Plan, Trader Tools, Trading Styles Leave a commentTrader Cheat Sheet #4 – Murrey Math Lines

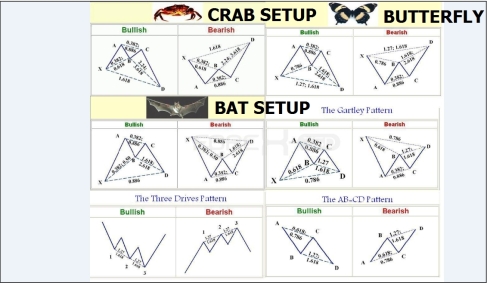

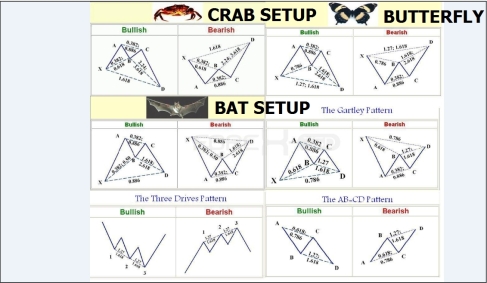

Trader Cheat Sheet #3 – Harmonic Patterns

Posted: February 27, 2013 Filed under: Cheat Sheet, Free Tools, Setups 2 Trade, Trader Tools, Trading Plan, Trading Styles | Tags: 2013, Cheat Sheet, Free Tools, Setups 2 Trade, Trade Plan, Trader Tools, Trading Styles Leave a commentTrader Cheat Sheet #3 – Harmonic Patterns

Harmonic Patterns In The Markets

Harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. At the root of the methodology is the primary ratio, or some derivative of it (0.618 or 1.618). Complementing ratios include: 0.382, 0.50, 1.41, 2.0, 2.24, 2.618, 3.14 and 3.618. The primary ratio is found in almost all natural and environmental structures and events; it is also found in man-made structures. Since the pattern repeats throughout nature and within society, the ratio is also seen in the financial markets, which are affected by the environments and societies in which they trade. (Don’t make these common errors when working with Fibonacci numbers – check out Top 4 Fibonacci Retracement Mistakes To Avoid.)

Issues with Harmonics

Harmonic price patterns are extremely precise, requiring the pattern to show movements of a particular magnitude in order for the unfolding of the pattern to provide an accurate reversal point. A trader may often see a pattern that looks like a harmonic pattern, but the Fibonacci levels will not align in the pattern, thus rendering the pattern unreliable in terms of the Harmonic approach. This can be an advantage, as it requires the trader to be patient and wait for ideal set-ups.

Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points. The danger occurs when a trader takes a position in the reversal area and the pattern fails. When this happens, the trader can be caught in a trade where the trend rapidly extends against them. Therefore, as with all trading strategies, risk must be controlled.

It is important to note that patterns may exist within other patterns, and it is also possible that non-harmonic patterns may (and likely will) exist within the context of harmonic patterns. These can be used to aid in the effectiveness of the harmonic pattern and enhance entry and exit performance. Several price waves may also exist within a single harmonic wave (for instance a CD wave or AB wave). Prices are constantly gyrating; therefore, it is important to focus on the bigger picture of the time frame being traded. The fractal nature of the markets allows the theory to be applied from the smallest to largest time frames.

Trader Quote # 21

Posted: October 29, 2012 Filed under: Setups 2 Trade, Trader 2 Trader, Trading Plan, Trading Rules, Trading Styles, Trading System | Tags: 2012, Cheat Sheet, Quotes, Setups 2 Trade, Trade Plan, Trader2Trader, Trading Rules, Trading Styles Leave a commentTrader Quote # 21

The Great Sun Tzu 5 Steps for War (Trading)

Trading Sun Tzu -“Military Method, we have,

1. Measurement;

2. Estimation of Quantity

3. Calculation;

4. Balancing of Chances;

5. Victory.” Sun Tzu

==== Definitely One of the Best Quotes for Trading – Simple & Beautiful! . For those that don’t have a trading plan, look no further! Lolz 🙂 . This is a 5 Step Process for Trading and more!

1. Measurement – I would see it as to complete beforehand all your technical & fundamental analysis in the Monthly, Weekly , Daily, 4 hrs, 1hrs ,30 min Time-frames to see the big picture , the “conditions of the battlefield”.

2. Estimation of Quantity – How many Troops will you deploy , where & why? Great money management is the key here. Money management as a per troop basis is a great way to “see” and “feel” your risk. This must be thought before the battle begins and used when the battle is fought!

3.Calculation – For me it is the entry / exit strategy to implement (setups). When is the most favorable moment to deploy your troops, if you know what I mean?

4. Balance of chances – Sounds similar but different in my eyes, I would ask myself if the probabilities are on my side. This is where I would do a Probability chart study analysis.

5. Victory – Love this One! Because you would think Victory is translated to Profit?!. To me Victory is to fully following your System Plan even if it results in a pre-calculated loss! Enjoy. Dimitri Feria ====

What do you think? What do this quote mean for you? Any comment or experiences you would like to share?

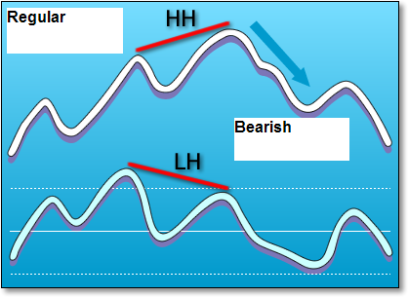

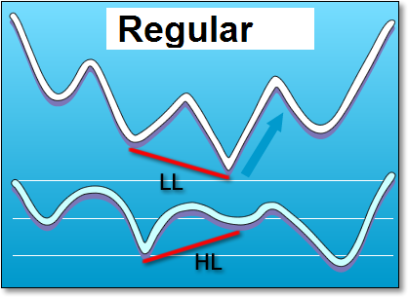

Trader Cheat Sheet #2 – Divergence

Posted: October 19, 2012 Filed under: Cheat Sheet, Free Tools, Setups 2 Trade, Trader Tools | Tags: 2012, Cheat Sheet, Free Tools, Setups 2 Trade, Trader Tools Leave a commentTrader Cheat Sheet #2 – Divergence

SOURCE:http://www.trading-naked.com/Divergence.htm